Staking offers a unique opportunity to earn passive income while helping to keep blockchain networks secure and efficient. But what makes staking so appealing and profitable? Let’s explore the five key reasons why staking in crypto is a game-changer for investors.

1. Passive Income: Earning Rewards Effortlessly

One of the most attractive parts of staking is the ability to earn passive income. When you stake your crypto assets, you lock them up in a wallet to support the operations of a blockchain network. In return, you receive rewards, usually in the form of more cryptocurrency. This is like earning interest on a savings account, but often with much higher returns.

The Power of Compound Interest

Staking lets you take advantage of compound interest. By continually reinvesting your staking rewards, you can significantly increase your holdings over time. This means that you earn rewards on your initial stake and on the rewards you’ve already earned, leading to exponential growth of your investment.

2. Supporting Blockchain Networks: Be Part of the Revolution

Staking isn’t just about making money; it’s also about helping blockchain networks stay healthy and secure. When you stake your assets, you help validate transactions and keep the network’s integrity. This decentralized process ensures that the blockchain remains secure and efficient, making you an important part of the network’s success.

Decentralization and Security

Decentralization is a core principle of blockchain technology. By staking your assets, you are promoting a decentralized network that is less likely to be attacked or manipulated. This not only protects your investment but also strengthens the overall ecosystem, creating a more robust and resilient blockchain infrastructure.

3. Reduced Risk Compared to Trading: Stability in Volatility

The crypto market is known for being very volatile, with prices often changing wildly in short periods. Trading in such an environment can be risky and stressful. Staking, on the other hand, offers a more stable alternative. When you stake your assets, you are less exposed to market volatility since your returns come from the staking rewards rather than price changes.

Long-Term Investment Strategy

Staking is ideal for those who prefer a long-term investment strategy. Instead of constantly watching the market and making quick decisions, staking allows you to take a more hands-off approach. By focusing on the long-term potential of your assets, you can ride out market volatility and enjoy steady returns over time.

4. Access to New Projects and Tokens: Be an Early Adopter

Many new blockchain projects use staking to encourage early adopters. By staking your assets in these projects, you can gain early access to new tokens and potentially lucrative opportunities. This gives you a front-row seat to new technologies and the chance to profit from their growth.

Diversifying Your Portfolio

Staking in new projects allows you to diversify your crypto portfolio. Diversification is a key strategy in reducing risk and maximizing returns. By spreading your investments across different projects, you can tap into various parts of the blockchain industry and benefit from multiple revenue streams.

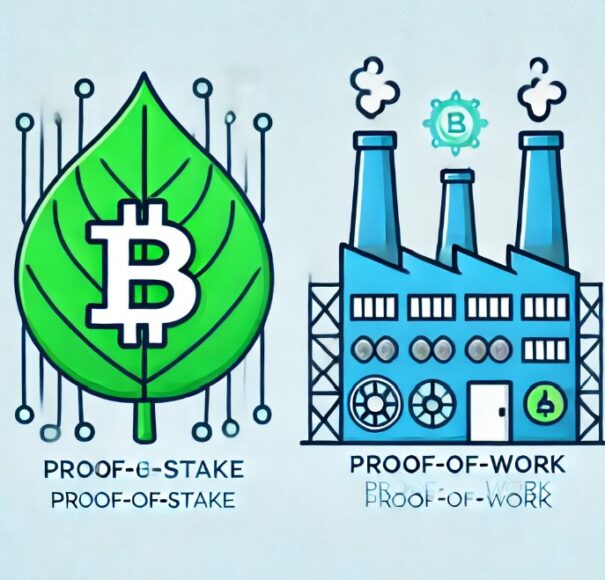

5. Environmental Benefits: Promoting Sustainable Practices

Proof-of-Stake (PoS) mechanisms, which require staking, are more energy-efficient than the traditional Proof-of-Work (PoW) models used by cryptocurrencies like Bitcoin. PoW involves solving complex math problems, using a lot of electricity. PoS, on the other hand, requires validators to hold and stake coins, which significantly reduces the energy use.

Green Crypto Movement

The environmental impact of crypto mining has been a growing concern. By participating in staking, you are supporting a more sustainable and eco-friendly approach to blockchain technology. This aligns with the broader green crypto movement, which aims to reduce the carbon footprint of digital currencies and promote environmentally friendly practices.

Conclusion: Staking for a Profitable Future

Staking in cryptocurrency offers numerous benefits that make it a profitable activity. From earning passive income and supporting blockchain networks to reducing risk and accessing new projects, staking provides a unique opportunity to grow your crypto assets. Moreover, by promoting sustainable practices, you contribute to a greener future for the blockchain industry.

As you consider your investment options, remember that staking is not just about immediate gains but also about long-term growth and stability. By staking your crypto assets, you can enjoy the rewards of your investment while playing a vital role in the evolution of blockchain technology. Whether you are a seasoned crypto enthusiast or a newcomer, staking offers a compelling way to make the most of your digital assets.